duluth mn sales tax rate

You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state. Free Unlimited Searches Try Now.

Duluth Sales Tax Rates for 2022.

. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The latest sales tax rate for Hermantown MN. Duluth in Minnesota has a tax rate of 838 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Duluth totaling.

The latest sales tax rate for Duluth GA. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a. Sales Tax State Local Sales Tax on Food.

2022 List of Minnesota Local Sales Tax Rates. 2020 rates included for use while preparing your income tax deduction. Instead of the 65 Motor Vehicle sales tax a 10 In-Lieu of Tax applies if the vehicle meets all of the following.

Average Sales Tax With Local. Duluth is located within St. What is the sales tax rate in Duluth Minnesota.

Minnesota Sales Tax St. The latest sales tax rates for cities in Minnesota MN state. Louis County Transit SalesUse Tax 05 and Duluth General Sales Tax 15.

411 West First Street Room 120 Duluth Minnesota 558021190 Telephone. The minimum combined 2022 sales tax rate for Duluth Minnesota is 888. The vehicle is 10 years or older and.

Rates include state county and city taxes. 2187305917 wwwduluthmngov An Equal Opportunity Employer. This rate includes any state county city and local sales taxes.

This amount is in addition to the Minnesota Sales Tax 6875 St. Lowest sales tax 45 Highest sales tax 8875 Minnesota Sales Tax. You may owe Use Tax on taxable goods and services used in Minnesota when no sales tax was paid at the.

An out-of-state retailer that exceeds Minnesota sales tax thresholds and make sales into Duluth. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

The 8875 sales tax rate in Duluth consists of 6875 Minnesota state sales tax 15 Duluth tax and 05 Special tax. This is the total of state county and city sales tax rates. At that time the rate was 3 percent.

Ad Get Minnesota Tax Rate By Zip. Sales Tax applies to most retail sales of goods and some services in Minnesota. See reviews photos directions phone numbers and more for Sale Tax Rate locations in Duluth MN.

Sales Tax Rate Calculator. You can print a 8875 sales tax table. There is no applicable county tax.

Minnesota Sales Tax Rate The state general sales tax rate is 6875 percent Minnesota first imposed a state sales tax August 1 1967. Find sales tax rates in Minnesota by address or ZIP code with the free Minnesota sales tax calculator from SalesTaxHandbook. This includes the sales tax rates on the state county city and special levels.

The results do not include special local taxessuch as admissions. For more information about taxable presence see Form ABR Minnesota. 2020 rates included for use while preparing your income tax deduction.

Sales Tax Guideline for Older Cars. The average cumulative sales tax rate in Duluth Minnesota is 883. Real property tax on median home.

Here is how much you would pay inclusive of sales tax. If the items you are buying.

Ebay To Collect Sales Tax In Minnesota Starting January 2019

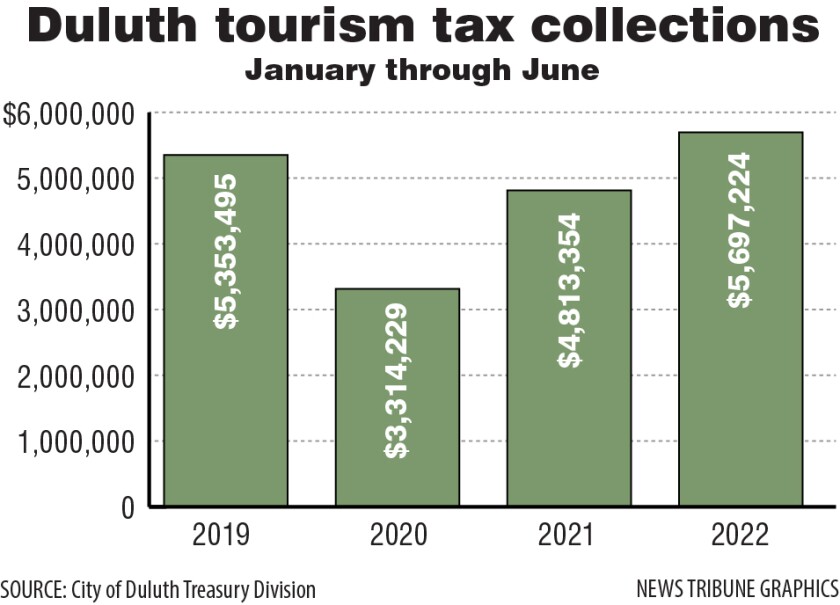

Duluth Tourism Revenues Rebound To Pre Pandemic Levels Duluth News Tribune News Weather And Sports From Duluth Minnesota

Is Seattle Expensive To Live In Quora

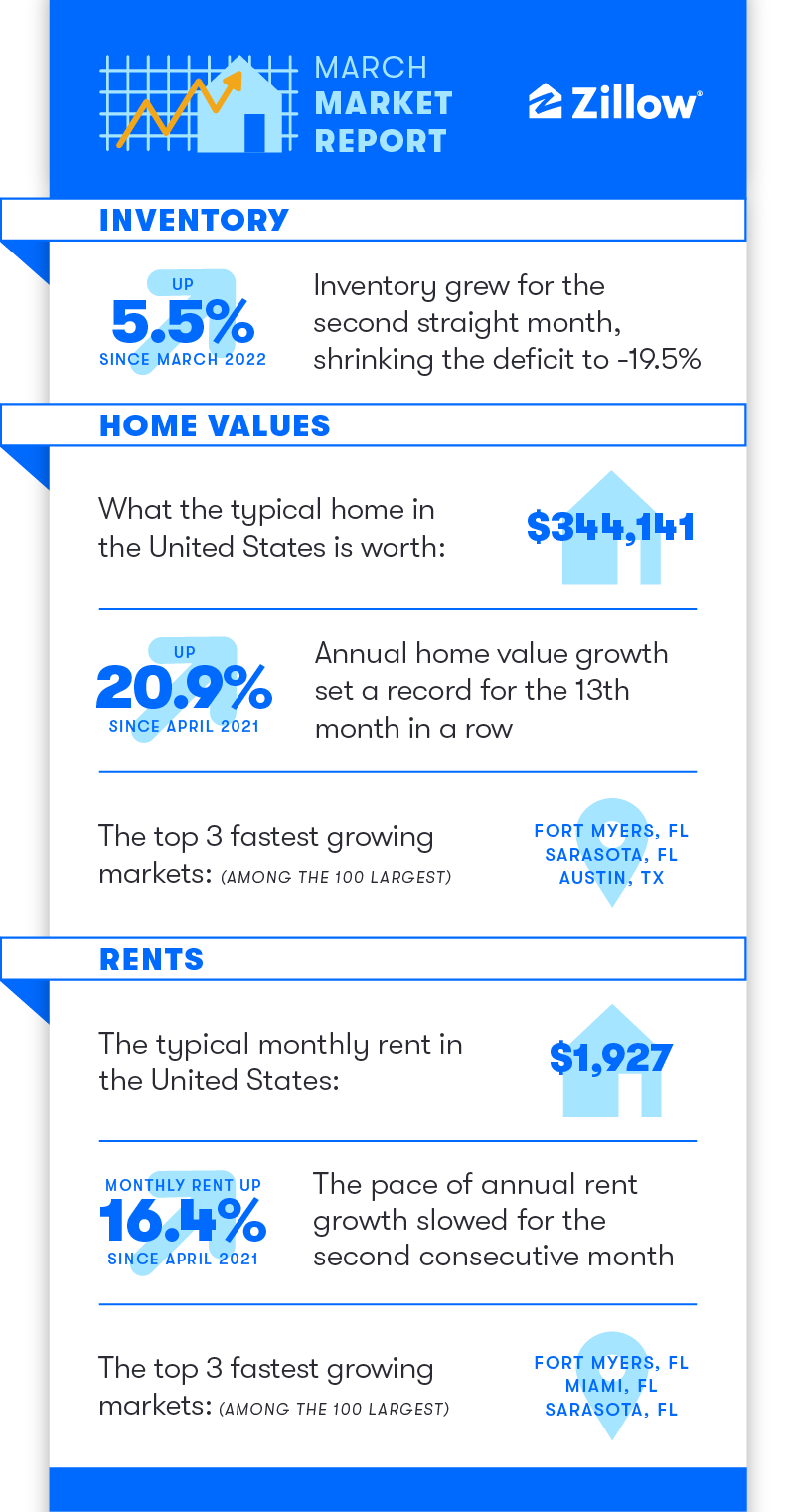

The Housing Market Is As Competitive As Ever Despite Soaring Costs April 2022 Market Report Zillow Research

Wilde Lake Reflection In Columbia Md Best Cities City Best Places To Live

Minnesota S Policymakers Need To Be Aware Of Iowa S Tax Reforms American Experiment

Most And Least Expensive States To Live In 2022

What Is The Property Tax Rate In Georgia Easyknock

Labor Force Participation Rates Minnesota Department Of Employment And Economic Development

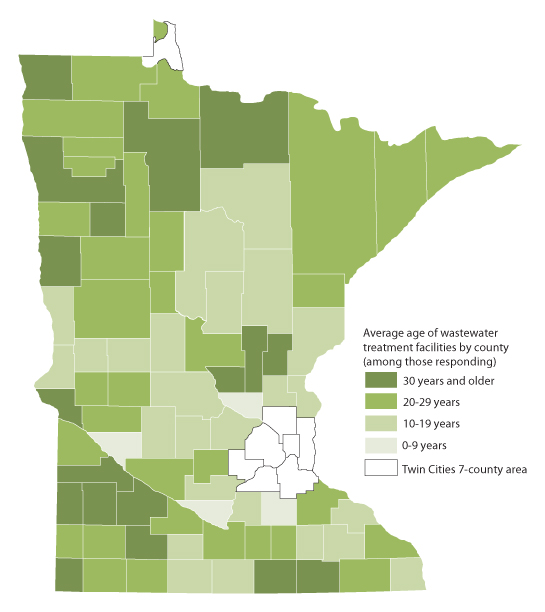

The State Of Water Center For Rural Policy And Development

Sales Tax Minnesota Prairie Roots

/cloudfront-us-east-1.images.arcpublishing.com/gray/7ID5I5L6QBKRHGVPXPNCJCXN6A.jpg)

Council Approves Sales Tax Increase For Cyrus Hotel

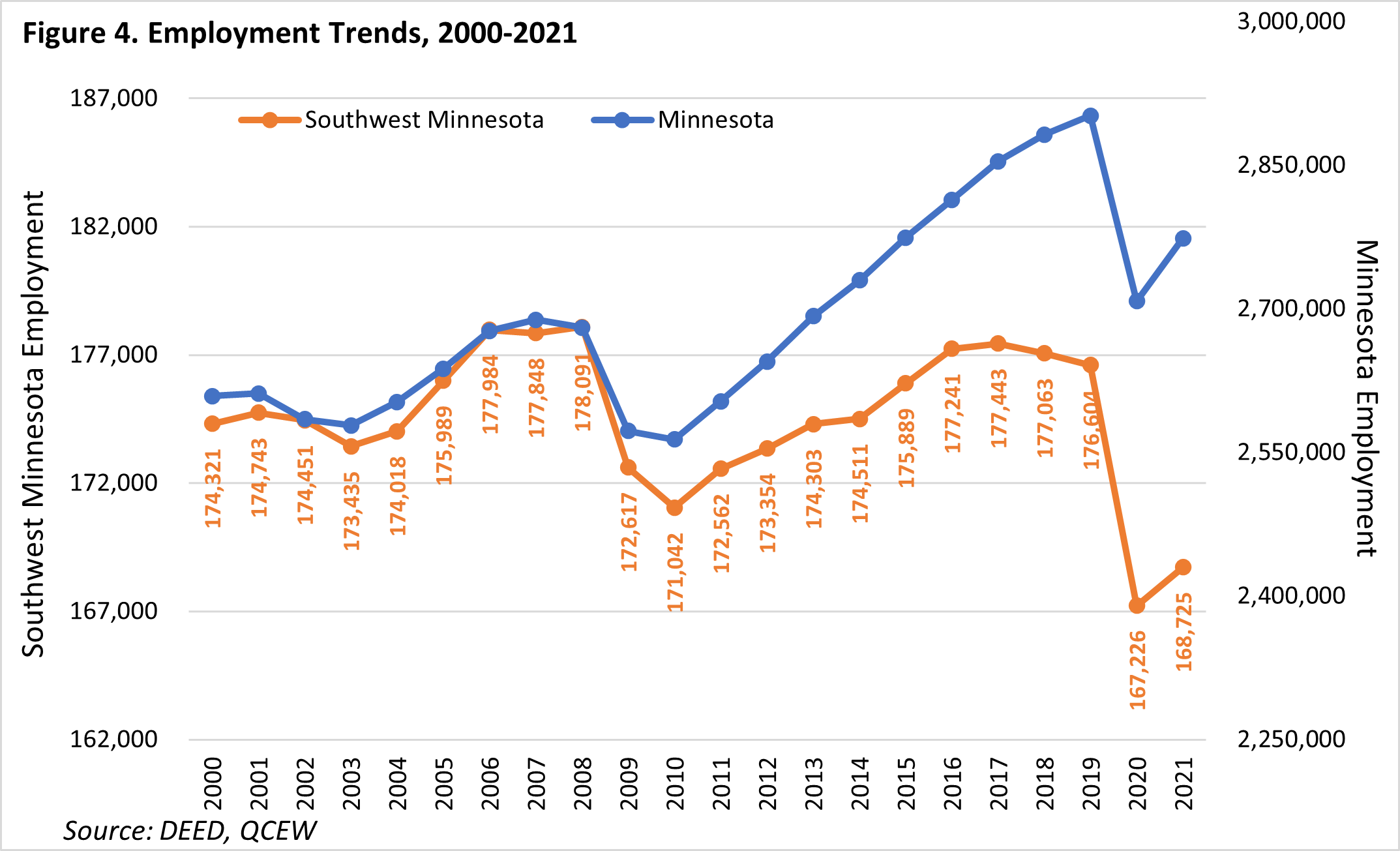

Holding Back Growth In Southwest Minnesota Minnesota Department Of Employment And Economic Development

Falta Llamarada Tomate Minneapolis State Code Administracion Oso Ornamento